Weekly Market Update 29.02.2016

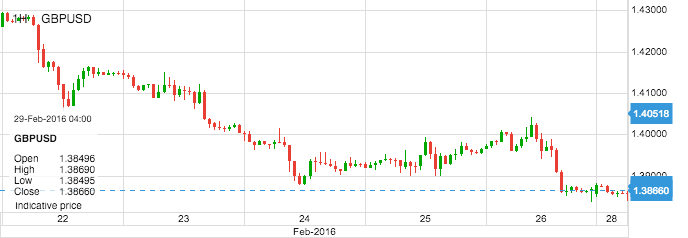

GBPUSD: GBPUSD decline continued last week due to increasing fears over the ramifications of a potential UK exit from the European Union, or “Brexit.” Sterling fell against the dollar, euro, yen, and others, to further extend its losses after British multinational bank, HSBC, issued a stern warning that a Brexit would damage UK economic growth substantially and potentially result in another 20% drop in the pound’s value against the dollar. Though the vote is not scheduled until early summer, speculation over the potentially severe consequences of an actual UK exit of the EU has increasingly weighed on the pound, especially since the June 23rd referendum date to vote on EU membership was confirmed this past week. In the US, there was good news on the employment front, as Unemployment Claims dropped to 262 thousand. The extension of GBPUSD’s recent plunge resulted in a breakdown below major support around the significant 1.4000 level, establishing nearly a seven-year low under 1.3900 in the process. This confirms a continuation of the longstanding bearish trend for the currency pair. Although GBPUSD is technically oversold after such sharp and prolonged declines recently, some semblance of a relief rebound may be forthcoming, both the overall fundamental outlook as well as the longer-term price momentum are currently pointing to the downside. Of course, this could change if near-future developments start to indicate a lower likelihood of a Brexit.

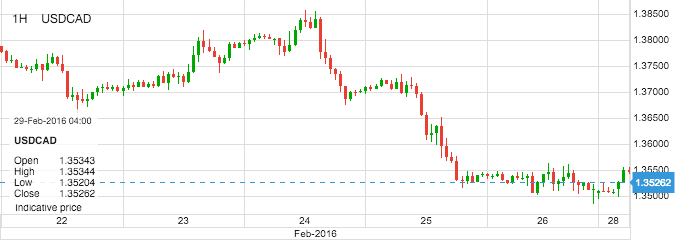

USDCAD: The Canadian dollar posted modest gains last week as crude oil markets were lifted by more substantive talk regarding a proposed OPEC/non-OPEC crude production cap at January’s output levels. Crude oil was also boosted by an International Energy Agency (IEA) report that projected US shale oil production to decrease substantially within the next two years. Specifically, the IEA expects to see shale production in the US decrease by 600,000 barrels per day in 2016 and by 200,000 additional barrels per day in 2017. Despite the Saudi oil minister asserting this past week that major oil-producing countries would not actually be seeking to cut output, crude oil was able to rally during the latter half of the week as speculators saw these recent developments as a potential start to alleviating the persistent oil oversupply situation. With this crude rally, the Canadian dollar was also pushed higher due to its close correlation with oil prices. This pressured the USDCAD currency pair to break down below key support around the 1.3600 level towards the latter part of the week. While a further recovery in crude oil prices is far from assured, a continued short-term bounce on hopes for a coordinated deal to cap output is certainly possible. In this event, with any sustained trading for USDCAD below the noted 1.3600 level, the next major downside support target resides around the key 1.3400 level.

UPCOMING KEY MARKET EVENTS

|

Date/Time* |

Currency |

Event |

Previous |

| 29 Feb/1000 |

EUR |

Consumer Price Index (YoY) (Feb) |

0.3% |

|

01 Mar/0330 |

EUR |

RBA Interest Rate Decision |

2.0% |

|

01 Mar/0815 |

USD |

Real Retail Sales (YoY) (Feb) |

-1.6% |

|

01 Mar/1500 |

USD |

ISM Manufacturing PMI (Feb) |

48.2 |

Time : GMT (Source: Fab Trader Platform)

Fixed Deposit Rates (USD)

| Tier | 30 Days | 90 Days | 180 Days | 360 Days |

|---|---|---|---|---|

| 50k-99k | 0.40 | 0.75 | 1.00 | 1.25 |

| 100k-499k | 1.50 | 1.75 | 2.00 | 2.50 |

| 500k-999k | 2.00 | 2.25 | 2.50 | 2.75 |

| 1 Million and above | 2.00 | 2.75 | 3.00 | 4.00 |

(Source: Fab Treasury)

Fixed Deposit Rates (EUR & GBP)

| Currency | 30 Days | 90 Days | 180 Days | 360 Days |

|---|---|---|---|---|

| EUR | 0.12 | 0.20 | 0.25 | 0.30 |

| GBP | 0.70 | 0.81 | 0.90 | 1.21 |

(Source: Fab Treasury)

Market Rates (from 5th - 11th October)

| Currency | Open | Close | High | Low |

|---|---|---|---|---|

| USDJPY | 112.508 | 113.979 | 111.027 | 113.940 |

| GBPUSD | 1.42830 | 1.44036 | 1.38371 | 1.38675 |

| EURUSD | 1.11029 | 1.11314 | 1.09097 | 1.09238 |

| AUDUSD | 0.71479 | 0.72577 | 0.71157 | 0.71190 |

| USDZAR | 15.40041 | 16.31031 | 15.05594 | 16.13898 |

| USDGHS | 3.97766 | 3.99123 | 3.92070 | 3.92070 |

| USDNGN | 199.32532 | 200.91636 | 198.17806 | 200.91636 |

| USDKES | 101.66819 | 101.88442 | 101.66819 | 101.86139 |

(Source: Fab Trader Platform & exchange-rates.org)

Metals and Stocks (from 5th - 11th October)

| Metal | Open | Close | High | Low |

|---|---|---|---|---|

| Silver | 15.3280 | 15.5760 | 14.6370 | 14.6848 |

| Gold | 1,225.32 | 1,253.26 | 1,201.62 | 1,222.32 |

| Stocks | ||||

| US 500 | 1,911.92 | 1,970.53 | 1,889.67 | 1,947.03 |

| HK 50 | 19,389.0 | 19,572.0 | 18,812.0 | 19,412.0 |

| UK 100 | 5,954.76 | 6,115.27 | 5,843.18 | 6,084.72 |

| Germany 30 | 9,440.35 | 9,583.35 | 9,118.95 | 9,491.45 |

(Source: Fab Trader Platform)

Dollar holds gains, G20 surprises no one

The dollar, euro and yen got off to a subdued start on Monday after a weekend meeting of G20 policymakers ended with no new coordinated action to spur global growth, an outcome that was not entirely surprising. That left the greenback holding onto broad gains made on Friday after a positive set of U.S. data kept alive the risk of a hike in U.S. interest rates this year. It was just under 114.00 yen JPY, little changed from where it closed in New York on Friday when it climbed 0.9 percent. The euro was also steady near 124.50 yen EURJPY. The common currency was flat at $1.0925 EUR, languishing near a one-month trough of $1.0912 set on Friday. Other major currencies were equally uninspired with the Australian dollar flirting with 71 U.S. cents AUD=D4, nursing a 1.5 percent drop on Friday. Its New Zealand counterpart was near 66 cents NZD=D4 after suffering a 1.4 percent slide. A communique from the Group of 20 finance ministers and central bankers flagged a series of risks to world growth, including volatile capital flows, a sharp fall in commodity prices and the potential "shock" of a British exit from the EU. G20 ministers agreed to use "all policy tools – monetary, fiscal and structural – individually and collectively" to reach the group's economic goals. (Source: reuters.com)

Oil prices rise, signs mount that market is bottoming out

Crude futures rose in early trading on Monday after gaining over 15 percent last week, with some indicators pointing to the possibility the market is showing signs of bottoming out.International Brent futures LCOc1 had climbed around half a dollar, or 1.4 percent, from their last close to $35.58 per barrel at 8.41 p.m. ET on Monday. U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 18 cents at $32.96 a barrel after gaining over 15 percent the previous week. Analysts said that first signs of a strengthening market outlook were appearing after a 20-month rout that has seen prices fall by 70 percent. "The U.S. crude market also seems to have passed the worst point and crude runs should start creeping higher taking pressure off inventory levels. The latest EIA data on U.S. production is also supportive as it indicates that the low prices are finally having an impact," said Richard Gorry, director of JBC Energy Asia. But he added that there was also "still a lot of downside risk" due to the huge overhang in production and stored supplies. "The Russian/Saudi production freeze talks continue to support the market, while in the U.S., shale producers continue to pull rigs from the ground in an effort to reduce spending. Baker Hughes data suggest U.S. oil rig counts fell by 13 to 400," ANZ bank said. Market data also suggests early signs of shifting sentiment. The amount of open positions in WTI crude contracts that bet on a further fall in prices has fallen over 17 percent since mid-February to their lowest level in 2016, although by historic levels their amount remains high. At the same time, financial speculators have sharply raised their bullish bets on oil after talk of a global production freeze and signs of falling U.S. shale crude output and growing gasoline demand. (Source: reuters.com)

Sterling Decline `a Foretaste' of Brexit Turmoil, Hammond Says

The collapse in the value of the pound provides “a foretaste” of the market turmoil that would follow a vote for Britain to leave the European Union, Foreign Secretary Philip Hammond warned on Thursday.

The pound has fallen more than 3 percent against the dollar this week, putting it on course for its worst week since 2009, after London Mayor Boris Johnson, one of Britain’s most popular politicians, announced he will be campaigning for an exit vote in the referendum on EU membership to be held on June 23. “A vote to leave is a vote for an uncertain future-that is a simple fact. That uncertainty would generate an immediate and negative reaction in financial markets,” Hammond told the House of Commons in London. “The mere possibility of a ‘Leave’ vote will have a chilling effect on business confidence even before the referendum,” he said. “We have had a foretaste of that this week in the currency markets.” Most online polls continue to be inconclusive, with a BMG online survey for London’s Evening Standard newspaper published Thursday showing “Remain” ahead of “Leave” by 44 percent to 41 percent, with 15 percent undecided. Two recent phone surveys, by contrast, have shown double-digit leads for staying in. (Source: bloomberg.com)