Weekly Market Update 30.11.15

Fixed Deposit Rates (USD)

| Tier | 30 Days | 90 Days | 180 Days | 360 Days |

|---|---|---|---|---|

| 50k-99k | 0.40 | 1.25 | 1.50 | 2.00 |

| 100k-499k | 2.00 | 2.50 | 2.75 | 3.50 |

| 500k-999k | 2.25 | 2.75 | 3.00 | 4.00 |

| 1 Million and above | 2.50 | 3.00 | 3.75 | 4.20 |

(Source: Fab Treasury)

Fixed Deposit Rates (EUR & GBP)

| Currency | 30 Days | 90 Days | 180 Days | 360 Days |

|---|---|---|---|---|

| EUR | 0.12 | 0.20 | 0.10 | 0.19 |

| GBP | 0.70 | 0.81 | 0.90 | 1.21 |

(Source: Fab Treasury)

Market Rates (from 5th - 11th October)

| Currency | Open | Close | High | Low |

|---|---|---|---|---|

| USDJPY | 122.703 | 122.725 | 123.258 | 122.252 |

| GBPUSD | 1.51855 | 1.50255 | 1.51969 | 1.50232 |

| EURUSD | 1.05915 | 1.05921 | 1.06892 | 1.05648 |

| NZDUSD | 0.65256 | 0.65471 | 0.66038 | 0.64260 |

| USDGHS | 3.79346 | 3.81554 | 3.83090 | 3.76623 |

| USDZAR | 13.97204 | 14.35803 | 14.51051 | 13.40137 |

| USDNGN | 199.04211 | 198.27759 | 199.23305 | 198.27759 |

| USDKES | 102.09701 | 102.00236 | 102.15912 | 102.00236 |

(Source: Fab Trader Platform & exchange-rates.org)

Metals and Stocks (from 5th - 11th October)

| Metal | Open | Close | High | Low |

|---|---|---|---|---|

| Silver | 14.0520 | 14.0755 | 14.3640 | 13.8960 |

| Gold | 1,076.63 | 1,057.26 | 1,081.14 | 1,052.47 |

| Stocks | ||||

| US 500 | 2,091.76 | 2,091.08 | 2,100.30 | 2,068.08 |

| Hong Kong 50 | 22,775.0 | 21,987.0 | 22,873.0 | 21,963.0 |

| UK 100 | 6,318.39 | 6,372.34 | 6,399.97 | 6,219.25 |

| Germany 30 | 11,126.40 | 11,290.65 | 11,368.65 | 10,867.15 |

(Source: Fab Trader Platform)

Kenya Central Bank Governor Gets Buffers Ready for Fed Shock

Kenya is ready to take action to protect the economy from potential market turmoil when the U.S. begins raising interest rates, having built up enough buffers to prepare for the event, central bank Governor Patrick Njoroge said.

While a rate increase in the U.S. has largely been priced in by financial markets, policy makers in East Africa’s largest economy will draw down reserves, adjust interest rates and tighten liquidity if there’s a currency shock, Njoroge said in an interview in Cape Town. Fiscal resources are also available to help cushion the blow, he said.

“We won’t be caught flat-footed as may have happened in the past,” Njoroge said on Nov. 27. “Because it’s been so anticipated, we have had the time to think through it. We are hoping for the best, but if the worst turns out, we can implement policies that will protect us from any shocks.”

Emerging markets have been rattled this year as speculation mounts that the U.S. Federal Reserve will raise interest rates for the first time in almost a decade, possibly as early as December. African currencies have been among the worst hit, with the slide in sentiment being worsened by the downturn in China and a slump in commodity prices from oil to copper.

Njoroge, who turns 54 on Wednesday, has tightened monetary policy aggressively since he took office in June, raising the benchmark interest rate by 150 basis points to 11.5 percent and reducing liquidity to bolster the currency. The central bank had foreign-exchange reserves of $6.75 billion as of Nov. 25, covering about 4.3 months of import needs.

The shilling has gained 3.3 percent since Sept. 8, when it reached an almost four-year low against the dollar of 106.67, allowing the central bank to begin boosting money supply. As interbank market rates and commercial lending rates ease, the central bank will consider reducing the benchmark rate after leaving it unchanged at the past three meetings, Njoroge said.

Njoroge is seeking to rein in inflation while supporting an economy hit by a slide in tourism following a spate of deadly attacks by the Somali militant group, al-Shabaab. Dry weather curbed tea output, the nation’s biggest source of foreign currency, while the El Nino weather pattern is set to put further pressure on farming production.

“It’s true that in the short run, the higher rates will have a contractionary effect on the economy,” he said. “But the point is that we are looking at restoring macro-stability, which will strengthen the economy in the long term.”

(Source: bloomberg.com)

African Currencies

GHANA

Ghana's cedi is expected to hold steady on dwindling corporate dollar demand amid a slowdown in market activities.

The local currency has been fairly stable in the past three months after slumping nearly 30 percent in the first half of the year. It was trading at 3.82 to the greenback at 1100 GMT on Thursday, compared to 3.83 a week ago.

"The cedi is holding steady and will likely extend it's recent stability to another week," said Joseph Biggles Amponsah of the Accra-based Dortis Research.

(Source: reuters.com)

KENYA

The Kenyan shilling is expected to trade in a range between 101.70 to 102.50 to the dollar due to sluggish appetite for greenbacks by importers before the holidays.

The shilling was trading at 102.10/20 on Wednesday afternoon compared with 102.15/25 at last Thursday's close. Thursday is a public holiday in Kenya.

"Demand for dollars is lethargic," said a senior currency trader with a commercial bank.

Firms usually wind down activity as the year draws to a close, curbing demand for dollars. The central bank has also been intervening with dollar sales to stabilise the currency.

(Source: reuters.com)

(Source: Fab Trader Platform)

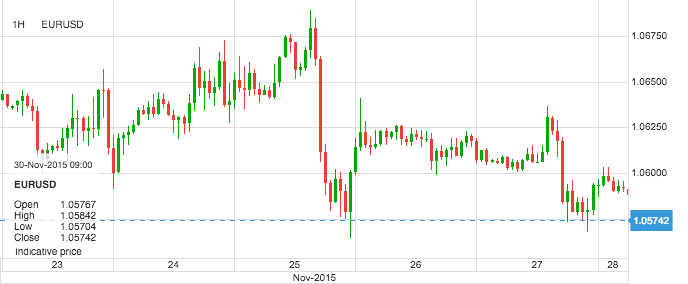

EURUSD

EURUSD dipped to new lows earlier this week before catching a bid midweek and bouncing back modestly. closing another week in the red. With the pair failing to follow through higher on the back of its previous gains the past week, further bear pressure is likely in the new week. This development now leaves EUR eyeing its key support located at the 1.0519 level. Conversely, resistance comes at 1.0700 level with a cut through here opening the door for more upside towards the 1.0750 level. The ECB decision in which new measures are expected, is undoubtedly the big event of the week

(Source: Fab Trader Platform)

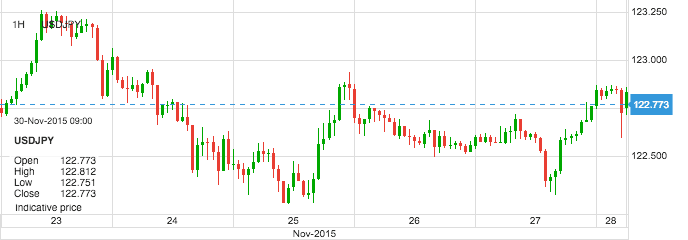

USDJPY

USD/JPY opened the week at 122.70 and climbed to a high of 123.26, testing resistance at 123.00. The pair dropped to 122.26 but recovered and closed the week at 122.25. The sharp rally on Monday was as a result of disappointing Q3 GDP report from Japan, but dollar bulls were unable to maintain the momentum and the pair is trading essentially unchanged.

| Date/Time | Event | Affected Currency | Previous |

|---|---|---|---|

| 01 Dec/01:00 | Bank of Japan Governor Kuroda Speech | JPY | |

| 01 Dec/03:30 | RBA Rate Statement | AUD | |

| 01 Dec/08:55 | Unemployment Change (Nov) | EUR | -5K |

| 02 Dec/15:00 | BoC Interest Rate Decision | CAD | 0.5% |

| 03 Dec/12:45 | ECB Interest Rate Decision | EUR | 0.05% |

| 04 Dec/13:30 | Unemployment Rate (Nov) | USD | 5% |