Daily Market Update 25th November 2016

ECONOMIC DATA OF THE DAY

| Time | CY | Indicator | Forecast | Actual | Previous |

|---|---|---|---|---|---|

| 13:00 | SI | CPI YoY | 0.00% | -- | -0.20% |

| 15:00 | MA | BNM Overnight Policy Rate | 3.00% | -- | 3.00% |

| 16:00 | FR | Markit France Manufacturing PMI | 51.5 | -- | 51.8 |

| 20:00 | US | MBA Mortgage Applications | -- | -- | -9.20% |

| 21:30 | US | Initial Jobless Claims | 250k | -- | 235k |

| 21:30 | US | Durable Goods Orders | 1.70% | -- | -0.30% |

| 23:00 | US | U. of Mich. Sentiment | 91.6 | -- | 91.6 |

| 23:00 | US | New Home Sales | 590k | -- | 593k |

SPEECHES

- 15:00 – MA - BNM Overnight Policy Rate

- 19:30 – UK - BOE Policy Maker Kristin Forbes Speaks in London

- 20:30 – PO - Bank of Portugal Governor Speaks in Lisbon

OVERNIGHT NEWS

US:

- Despite initial USD weakness in Europe sessions the USD found support in the US.

- Overnight US Existing home sales data saw an unexpected boost rising m/m by 2% versus an expected -0.6% decline

- Dow Jones traded at 19,000 for the first time as the positive momentum in stocks continued despite strength in the USD and the upward trajectory on US yields. The move driven largely by expectations of positive growth momentum in the US in the wake of Trump’s policies.

- Consumer confidence in Europe improved m/m and beat expectations however, remained in negative territory.

- UK Chancellor Hammonds budget speech to parliament will be closely watched today as he is set to but the budget to work helping ordinary families. His budget will pledge 1.4 Billion GBP to build new homes as well as raising the minimum wage.

FOREIGN EXCHANGE (INDICATIVE RATES)

| Currency | Last | % Change | Overnight Range |

|---|---|---|---|

| DXY | 101.05 | -0.01 | 100.65 - 101.32 |

| EURUSD | 1.0637 | -0.03 | 1.0584 - 1.0658 |

| USDJPY | 110.58 | 0.29 | 110.27 - 111.36 |

| AUDUSD | 0.7376 | 0.45 | 0.7364 - 0.7414 |

| GBPUSD | 1.2493 | -0.57 | 1.2385 - 1.2513 |

COMMODITIES (INDICATIVE RATES)

| Currency | Price USD | % Change | Overnight Range |

|---|---|---|---|

| Gold | 1212.32 | -0.16 | 1206.21 - 1221.16 |

| Silver | 16.65 | 0.34 | 16.54 - 16.90 |

| Oil (BRENT) | 49.12 | 0.45 | 48.14 - 49.96 |

| Oil (WTI) | 48.03 | 1.14 | 47.17 - 49.20 |

COMMODITIES

Precious Metals: Spot gold slid and continued to seek support around $1,200 level, while silver climbed together on demand for industrial metals. Gold holdings ETP declined for an eighth consecutive session, the longest run in almost a year as Dec rate hike is almost a certainty.

Oil: Oil price retreated from recent rally as OPEC talks in Vienna Tuesday didn’t resolve whether Iraq and Iran will join any production cuts, instead deferring the crucial matter to ministers who will meet Nov. 30. On charts, WTI struggled to break above the upward trendline resistance formed since Feb-Sep around $48.40.

FOREX NEWS

- U.S. stocks post a second day of all-time record highs in spite of softer crude prices, as strong housing data and retail earnings were posted. The Dow closed above 19000 and the S&P pushed beyond 2,200 for the first time, amid dollar consolidation and the bond market’s temporary reprieve. The S&P 500 edged up 4.76 points to 2,202.94, with telecoms post the best win with 2.1% increase in prices.

- DSW Inc. surged by 7.9% after the discount shoe retailer reported adjusted Q3 EPS of $0.51 better than Mkt est: $0.49, and the company also raised its forecast in FY adjusted EPS.

- European stocks edged higher on the back of a rally in metal prices boosting commodity producers. The Stoxx Europe 600 crept up by 0.2%, to 341.02. In London the FTSE 100 gained 0.6%, to 6,819.72.

- Swiss watch makers generally suffered from data confirmed the largest monthly drop for Swiss watch exports for seven years. Swatch Group slid 3.6% and Cie Financiere Richemont dropped by 3%.

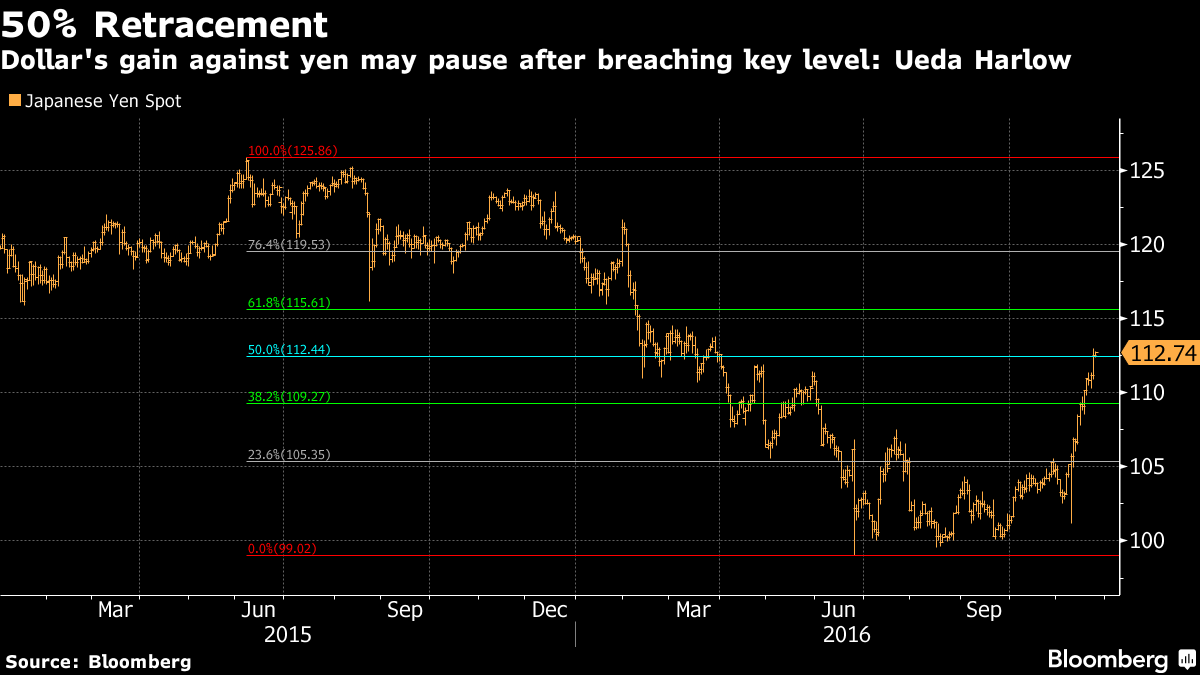

Dollar Approaches 8-Month High Versus Yen on Fed Rate Hike Bets

- Currency gauge set for highest close since 2004 start of data

- Dollar rally against yen may pause in short term: Ueda Harlow

The dollar approached an eight-month high against the yen after government reports Wednesday showed U.S. economic growth remains intact, supporting the case for an increase in interest rates.

The greenback gained against all of its Group-of-10 peers as the odds that the Federal Reserve will tighten at its December meeting rose to 100 percent, with additional moves by June climbing to 66 percent from 58 percent at the start of this week. Orders for business equipment increased in October for the fourth month in the last five, while sales also advanced, helping to extend the greenback’s gains since the Nov. 8 election.

Read the full article at bloomberg.com