Daily Market Update 26th October 2016

ECONOMIC DATA OF THE DAY

| Time | CY | Indicator | Forecast | Actual | Previous |

|---|---|---|---|---|---|

| 08:30 | AU | CPI QoQ | 0.50% | 0.70% | 0.40% |

| 08:30 | AU | CPI YoY | 1.10% | 1.30% | 1.00% |

| 13:00 | SI | Industrial Production YoY | 1.00% | -- | 0.10% |

| 13:00 | SI | Industrial Production SA MoM | -1.20% | -- | 0.00% |

| 19:00 | US | MBA Mortgage Applications | -- | -- | 0.60% |

| 22:00 | US | New Home Sales | 600k | -- | 609k |

| 22:00 | US | New Home Sales MoM | -1.50% | -- | -7.60% |

SPEECHES

- 16:00 – EUR – ECB’s Hansson speaks on outlook for Estonia, Euro area

OVERNIGHT NEWS

US:- US consumer confidence surprised to the downside, however this did little to alter December hike expectations. Rather on the back of William’s and his peers speaking last night, the probability of a hike in December ticked incrementally higher to 73%.

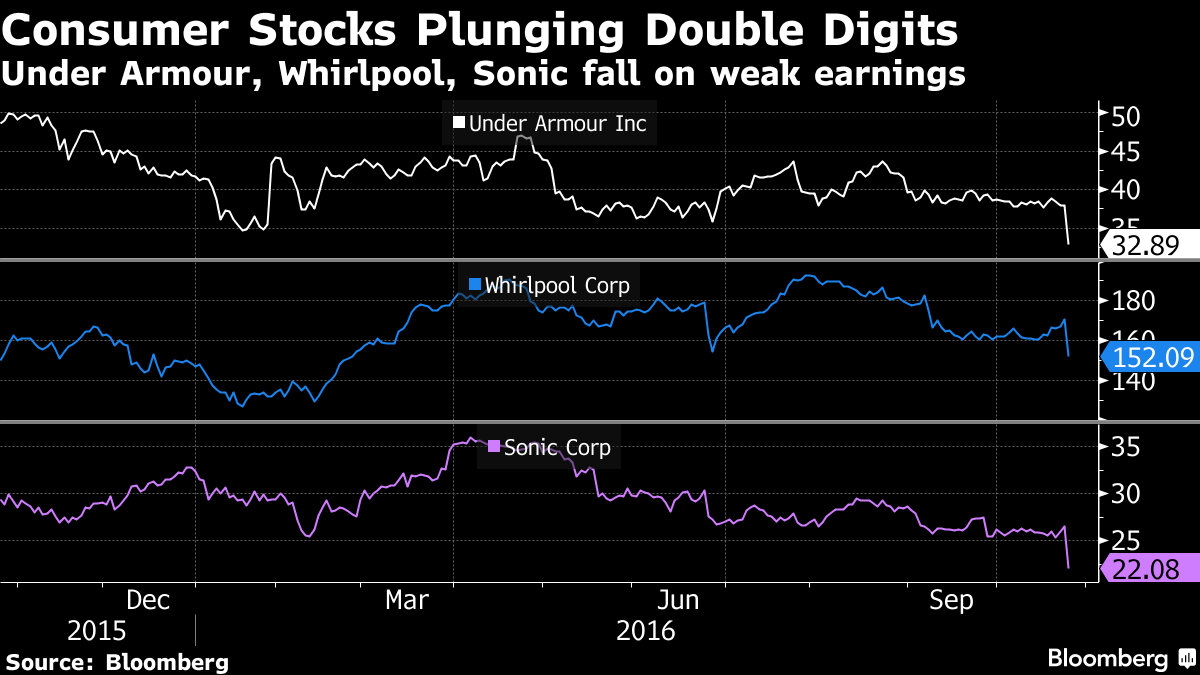

- Consumer discretionary stocks such as Under Armour, Whirlpool etc. reported weak earnings and their stocks fell. The weak earnings from consumer discretionary names coupled with poor US consumer confidence numbers was enough to temper risk sentiment.

- BoE’s Carney spoke at the House of Lords yesterday, saying he would only tolerate a certain amount of inflation overshoot as a function of the weakening pound. Comments hint towards the potentially difficult situation the BOE finds themselves in, with inflation on the rise but outlook uncertainty increasing post Brexit.

FOREIGN EXCHANGE (INDICATIVE RATES)

| Currency | Last | % Change | Overnight Range |

|---|---|---|---|

| DXY | 98.72 | -0.04 | 98.61 - 99.12 |

| EURUSD | 1.0889 | 0.06 | 1.0851 - 1.0905 |

| USDJPY | 104.22 | 0.04 | 104.12 - 104.87 |

| AUDUSD | 0.7646 | 0.46 | 0.7589 - 0.7655 |

| GBPUSD | 1.2188 | -0.41 | 1.2083 - 1.2244 |

COMMODITIES (INDICATIVE RATES)

| Currency | Price USD | % Change | Overnight Range |

|---|---|---|---|

| Gold | 1273.87 | 0.75 | 1262.12 - 1276.78 |

| Silver | 17.77 | 0.98 | 17.52 - 17.92 |

| Oil (BRENT) | 50.79 | -1.30 | 50.22 - 51.83 |

| Oil (WTI) | 49.96 | -1.11 | 50.21 - 51.02 |

COMMODITIES

Precious Metals: Since falling more than 50 dollars in a single day 3 weeks ago, gold has been consolidating in a range from 1250 and 1275. MACD crossover was seen last week but price remains capped at 1275. Prefers to buy on dip at prices closer to 1250 which will offer a better risk to reward ratio.

Oil: Data from Baker Hughes reported an increase in rig count. This is the 17th consecutive rise in rig count. Oil price action suggests that it may be trading in its new found range [51 - 53] before a break in either direction. Iraq commented over the weekend that it may not join the production cut in the OPEC meeting.

FOREX NEWS

- The Dow and S&P 500 ended off their lows of the session flat, while the Nasdaq rallied. All three indexes ended a string of back-to-back weekly declines.

- General Electric Co. fell 0.3% to $28.98, ending well off its lows of the session after posting worse-than-expected revenue growth in its latest quarter and said it would increase its stock-buyback program by $4 billion after disappointing in the first half of the year.

- Microsoft (+4.21%) reported profits for its fiscal first quarter Thursday that beat Wall Street’s expectations by more than 11%, thanks to cloud computing and a bit of financial engineering. Investors responded by boosting Microsoft shares higher than $60, up almost 6% after-hours

- Burberry shares leapt to the top of the benchmark, as much as 8.1% after a report the British fashion house may merge with American high-end goods retailer Coach Inc. (-1.00%) in a $20 billion deal.

- British American Tobacco pared early gains, leaving BAT down 2.9% after the company proposed buying the stake in Reynolds American Inc. (+14.01%) that it does not already own for $47 billion.

- Home-improvement, homebuilding stocks fall to multi-month lows

- Double-digit slumps for Under Armour, Whirlpool, Sonic

The American consumer might not be as healthy as investors thought.

Disappointing results from fast-food chains to makers of appliances, sports apparel and home-renovation products sparked a selloff in consumer-discretionary stocks amid speculation the economy’s biggest engine is sputtering. The S&P 500 Index fell 0.4 percent to 2,143.16 at 4 p.m. in New York, slipping from a two-week high and closing near its average price during the past 100 days. Apple Inc. declined in after-hours trading following its earnings report.

Read the full article at bloomberg.com