Daily Market Update 10th October 2016

ECONOMIC DATA OF THE DAY

| Time | CY | Indicator | Forecast | Actual | Previous |

|---|---|---|---|---|---|

| 17:00 | GR | CPI YoY | -0.60% | -- | -0.90% |

| 20:00 | IN | Industrial Production YoY | -0.30% | -- | -2.40% |

SPEECHES

- No speech

OVERNIGHT NEWS

US:- Non-Farm Payrolls rose below expectations 156k (Exp. 172k) from an upawardly revised 167k (Prev. 151k) in August and a downwardly revised 252k in July (Prev. 275k). Professional and business services added 67,000. Healthcare jobs increased 33,000. Food service jobs grew 30,000. Retailers added 22,000. Employment in the mining sector was flat. Manufacturing employment fell 13,000.

- The unemployment rate went up to 5.0% (Exp. 4.9%). Private-sector worker wages rose $0.06, or 0.2% MoM (Mkt est: +0.3%), to $25.79 an hour. Wages grew 2.6% YoY (Mkt est: +2.6%). The average workweek last month increased a tenth of an hour to 34.4 hours.

- Inventories declined 0.2% (Mkt est: neg-0.1%) from the advance economic indicator estimate of neg-0.1%. The component of wholesale inventories that is used in the calculation of GDP - wholesale stocks excluding autos - dropped 0.3%.

FOREIGN EXCHANGE (INDICATIVE RATES)

| Currency | Last | % Change | Overnight Range |

|---|---|---|---|

| DXY | 96.52 | -0.14 | 96.40 - 97.19 |

| EURUSD | 1.1194 | 0.45 | 1.1104 - 1.1205 |

| USDJPY | 104.02 | -0.93 | 102.86 - 104.03 |

| AUDUSD | 0.7599 | -0.04 | 0.7553 - 0.7624 |

| GBPUSD | 1.2435 | -1.44 | 1.1841 - 1.2623 |

COMMODITIES (INDICATIVE RATES)

| Currency | Price USD | % Change | Overnight Range |

|---|---|---|---|

| Gold | 1257.08 | 0.22 | 1241.51 - 1265.48 |

| Silver | 17.55 | 1.32 | 12.10 - 17.65 |

| Oil (BRENT) | 51.93 | -1.10 | 51.33 - 52.84 |

| Oil (WTI) | 49.81 | -1.25 | 49.40 - 50.74 |

COMMODITIES

Precious Metals: Last week, gold broke key technical support of $1,300, while silver suffered its worst week since 2013 as it slumped about 8.4%, but managed to hold firm above its 200-DMA around $17.10. Despite an almost unchanged bullish exposure to commodities during the week ending October 4, there was big shift from precious metals to energy during the week ending October 4.

Oil: Brent declined after challenging June's peak level around $52.87, while WTI slipped below $50, as Russia’s Novak doesn’t see accord with OPEC being signed in Istanbul next week. Baker Hughes reported that US oil rig count rose by 3 to 428. During the week ending October 4, bullish bets on WTI crude oil jumped 40% or 73,051 lots to the 254,503 lots, the highest reading since May 2015.

FOREX NEWS

- U.S. stocks declined last Friday to register their first losing week in four, as crashed British pound raised investors' concern and September non-farm payrolls report didn't manage to bring back the confidence. The S&P 500 index slipped 7.03 points to 2,153.74 with materials (-1.8%) leading the way in losses.

- Honeywell International Inc. Dropped 7.5% after it lowered its FY guidance due to an unexpectedly weak September, which was caused by weak sales in aftermarket services for business-jet engines and hand-held scanners for shippers and logistics.

- Recreational vehicle retailer Camping World Holings Inc. rose 2.3% in their trading debut. It raised about $250mln through its IPO. The stock traded as high as $24.35, above the IPO price of $22.

- European stocks retreated amid risk aversion caused by crash in the value of the pound sterling. The European STOXX 600 index dropped 0.9% to 339.64. However In London the FTSE 100 climbed 0.6% to 7,044.39, with miners and multinationals being the biggest winners.

- Deutsche Bank edged up 0.5% after sources said the largest stake owner Qatari investors indicated that they do not plan to sell their shares. Even more, it could consider raising their stake to 25% if Deutsche decides to raise capital.

- RWE tanked 7.4% after spinout Innogy, which debuted on the stock market and had been struggling to trade above their issue price.

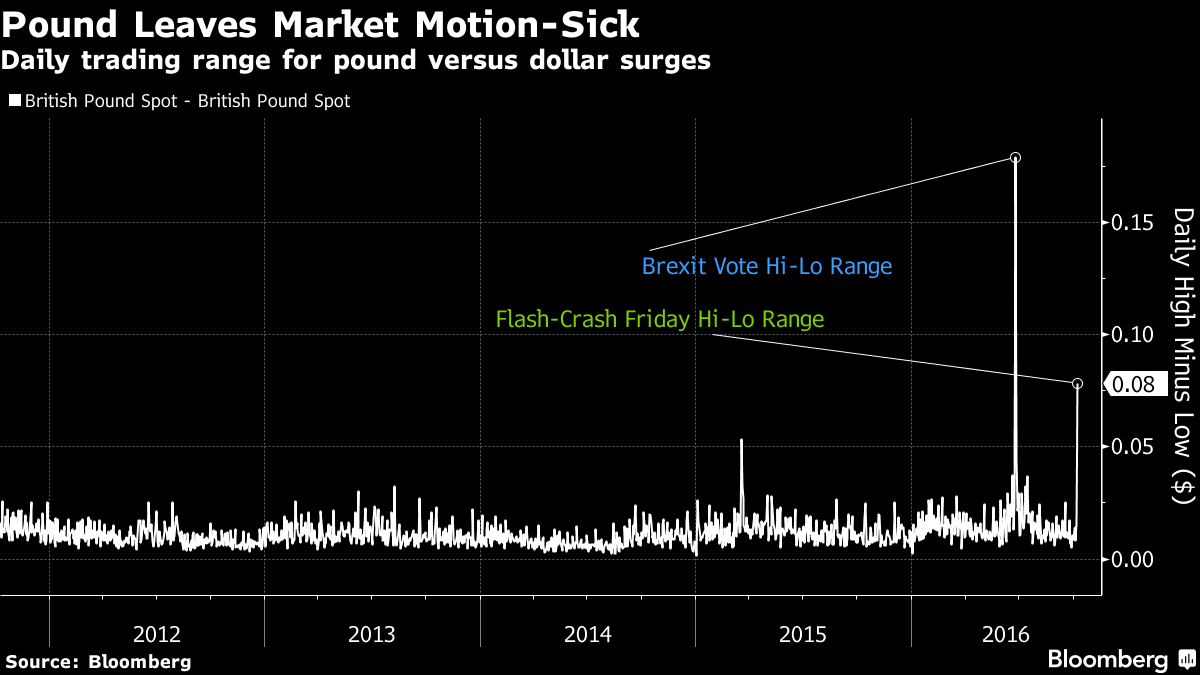

Pound’s Dramatic Week Leaves Traders Skeptical of Quick Recovery

After a dramatically dismal week for the pound punctuated by a flash crash in Asia, traders doubt it will shake off its tag of the worst-performing major currency in 2016.

They’re negative because sterling is held hostage by the prospects of a hard Brexit and its impact on the U.K. economy. That adds to concern over how the third-most traded currency pair, the pound-dollar, could crash and bounce back with no apparent explanation beyond speculation that computer-driven trading was to blame.

Read the full article at bloomberg.com