Daily Market Update 16th September 2016

ECONOMIC DATA OF THE DAY

| Time | CY | Indicator | Forecast | Actual | Previous |

|---|---|---|---|---|---|

| 20:30 | US | CPI MoM | 0.10% | n/a | 0.00% |

| 20:30 | US | CPI Ex Food and Energy MoM | 0.20% | n/a | 0.10% |

SPEECHES

- No Speeches

OVERNIGHT NEWS

- US:

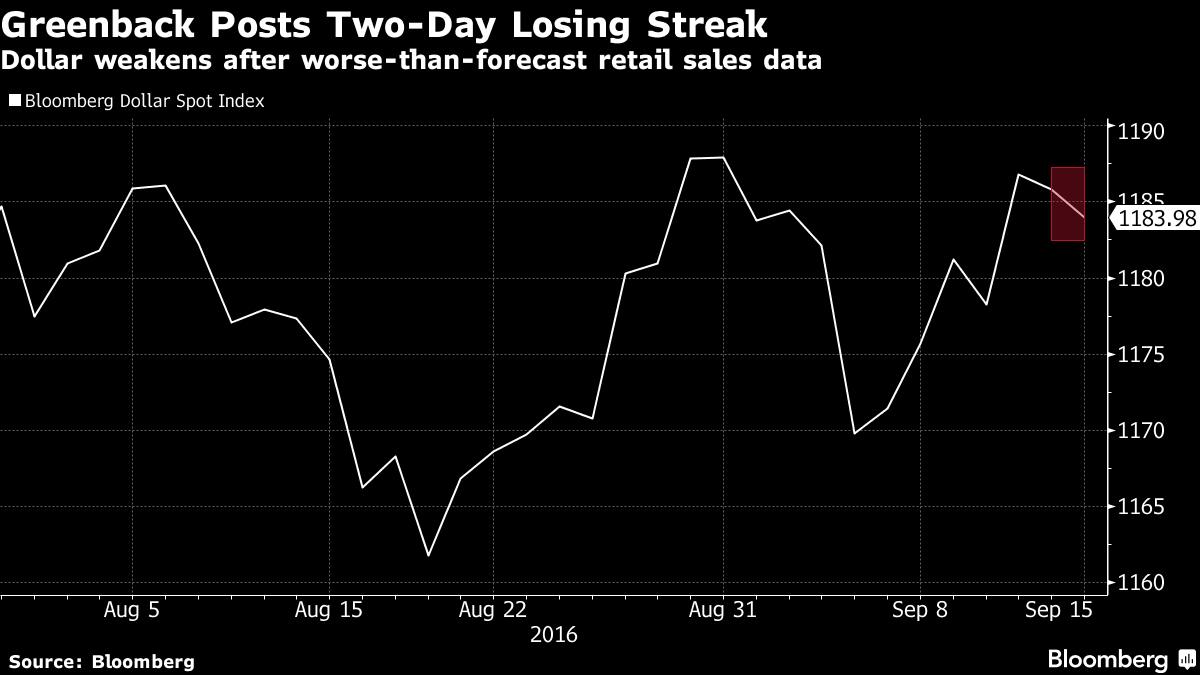

- Retail Sales dropped 0.3% MoM (Exp. -0.1%) from +0.1% in July. Ex- autos, retail sales dropped to 0.1% (Exp. +0.2%). Ex- autos and gasoline, sales also dropped 0.1% (Exp: +0.3%). Import Prices declined 0.2% (Exp. -0.1%) led by Industrial prices and auto prices. After charging through the second quarter, the consumer is showing signs of exhaustion at the start of the second half of 2016. Core sales, which are used to calculate GDP figures, unexpectedly fell for a second month. A further slowing in consumer spending, which makes up the biggest part of the economy, could make for a smaller rebound this quarter.

- Industrial Output dropped 0.4% (Exp. -0.2%). Output at factories alone, which makes up about 75 percent of total production, declined 0.4 percent, biggest drop since March

- Jobless claims rose 1000 to 260,000 (Exp. 265k) and the 4-week average remains close to the lows at 261k. This is one part of the economy that continues to show good numbers

- PPI increased as expected 0.1% MoM

- UK:

- Bank of England kept the rates at 0.25% and the asset purchase at the asset purchase at $435 Bn. BOE indicated that there is still a chance of another rate cut this year as they assess the potential longer-term fallout from Britain’s decision to leave the EU. While the nine-member Monetary Policy Committee noted that recent near-term data had been stronger than anticipated since the Brexit vote, it couldn’t draw inferences for its longer-term forecasts.

- BOJ:

- The WSJ is saying that the BOJ board is split over the Monetary Easing Program. Three still favor current policy of bond purchases with negative rate. Others no longer confident in bond purchases. Some suggest changing bond purchase target of annual 80t yen to range of perhaps 70t-90t. Two sides differ on whether bond supply is large enough for purchases. Those favoring range say supply limit could be reached in year or two and believe alternative should be sought. One alternative is long-term rate target and pledge to buy on

FOREIGN EXCHANGE (INDICATIVE RATES)

| Currency | Last | % Change | Overnight Range |

|---|---|---|---|

| DXY | 95.29 | -0.04% | 95.08 – 95.56 |

| EURUSD | 1.1245 | -0.05% | 1.12 – 1.13 |

| USDJPY | 101.86 | -0.32% | 101.94 - 102.76 |

| AUDUSD | 0.7507 | 0.62% | 0.74 – 0.75 |

| GBPUSD | 1.3235 | 0.03% | 1.32 - 1.33 |

COMMODITIES (INDICATIVE RATES)

| Currency | Price USD | % Change | Overnight Range |

|---|---|---|---|

| Gold | 1314.75 | -0.62% | 1309.40-1328.71 |

| Silver | 18.98 | 0.12% | 18.82-19.22 |

| Oil (BRENT) | 46.59 | 1.61% | 45.67-47.00 |

| Oil (WTI) | 43.91 | 0.76% | 43.26-44.34 |

COMMODITIES

Precious Metals: Gold dropped waiting for the Fed decision next week. Besides China is closed today for holiday and it is one of the biggest market participant. We are now trading close to the support at the 100d MA at 1305. A break of this level could bring Gold back to 1250

Oil: All 14 OPEC countries will attend an informal meeting with Russia on Sept. 27 in Algiers, according to a person familiar. The group’s crude exports will decline by 40,000 barrels a day to 23.68 million in the four weeks to Oct. 1, Oil Movements said. Oil bounced slightly after the strong fallout this week.

FOREX NEWS

- U.S. stocks closed broadly higher, boosted by lacklustre retail sales and industrial production data that and stabilisation in oil prices. Both DJIA and S&P500 gained 1%. All eleven sectors closed higher led by technology (+1.7%) and VIX plunged 10.1%, to 16.30.

- Nasdaq (+1.47%) enjoyed the sharpest rise among its peers, closing 1.5%, higher at 5,249.69 as Apple Inc. rose 3.4%, extend its gains to 12% for this week after disclosing that its iPhone 7 Plus have sold out globally.

- Aerie Pharmaceuticals Inc. spiked 45% after the drug discovery company’s treatment for lowering fluid pressure inside the eyeball yielded promising results.

- European markets were mostly higher as STOXX 600 index rose 0.6%, to 340.34 after the Bank of England held interest rates as expected on Thursday.

- Hennes & Mauritz dipped 4.3% after the Swedish clothing company said sales rose 7%, but were negatively affected in the second half of the month by exceptionally hot weather in most of the group’s markets.

Dollar Drops as Traders Trim Rate Bets After Retail Sales Fall

"There is a slim chance of something next week -- the weak data is killing the idea," said Win Thin, global head of emerging markets at Brown Brothers Harriman & Co. in New York. "We are pushing the Fed tightening into December more. It will take the wind out of the dollar’s sails."

Dollar bulls have been upended in recent weeks by mixed signals from policy makers on prospects for Fed monetary tightening. The U.S. currency has fallen 3.9 percent this year, reflecting the dimming outlook for the U.S. central bank’s ability to meet its forecast of two rate hikes this year.

Read More at bloomberg.com